PREFACE

Rule of law! Justice delayed is justice denied.

Issue 4 briefly depicted examples of the perfect UBS AG Client elderly victims. We will in this issue 5 observe factual procedures of UBS AG (Switzerland) and their collaborators continuing reign of terror against their USA Clients, especially the elderly Client victims within the USA. World authorities will be able to readily observe herein detailed UBS AG dubiously prosecuted or un-prosecuted USA criminal activities. We will continue to evidence that UBS AG behavior has been top down sanctioned by the USA Presidential Team UBS (Clinton, Bush II, Obama) receiving UBS deferred payments after leaving office. Let it be known President Donald Trump refused to join the USA Presidential Team UBS out of conviction to make good on his Presidential promises to American citizens. This was not well received by UBS AG (Swiss) or their USA collaborators.

We will center on the USA Federal & State Courts in Salt Lake City, Utah as USA collaborating facilitators for processing harvested UBS Client victims from other states. The Utah Courts are so proud of their profits there is even one of their graphs depicted below. Most of the illustrated UBS Client victim examples are Palm Beach County, Florida elderly initially invited to a honey pot trap lunch with “alike others”. There they have to fill out a personal information questionnaire to leave. There is always a big male at the door to see the questionnaire has been properly filled out. Those going further are then susceptible to the assigned UBS salesman mantra of target, solicit, recruit, isolate, control, dupe and loot.

Issue 5 will become the most lengthy issue due to the large number of interesting accumulated exhibits. It will always be under sustained construction to allow World readership constant up-dates. UBS and their collaborators’ shear arrogance allows clarity to these criminal schemes for the World to see. We hope to continue to glean from our international readership areas of most interest for the publication. We sprinkle our usual jokes, cartoons funny depictions et al throughout so as to enliven the subject matter.

We begin in Salt Lake City, Utah with documented Utah State & USA Federal Court UBS manipulations. A series of known spoliations and other fraudulent manipulations of Court records and procedures in USA Federal & State Salt Lake City, Utah and Palm Beach County, Florida Courthouses will be detailed. We present them to World readership in hopes UBS AG and others of their ilk will be put on notice. UBS elderly Client victim harvesting has been so successful Utah Court system makes a pamphlet with graphs (see below) depicting the massive court profits accrued. These Utah fraudulently configured court documents are then exported as true and correct foreign judgements to other USA states. They are not. In Florida, USA Federally unregulated Utah Industrial Bank “UBS Bank USA” criminally held itself out to the World as a Florida chartered and licensed bank from 2003 > 2010. It was neither. USA Federally unregulated Utah UBS Bank USA continues to fraudulently target, solicit, recruit, isolate, control, dupe and loot Florida citizens, especially the elderly. At the very same time in Ft Lauderdale, Florida USA Federal Judge Cohn was assigned three UBS cases (United States of America v UBS Case No. 09-60033-CR-COHN) and two criminal trials of UBS Chairman Raoul Weil (United States v Raoul Weil Case 08-60322-CR-COHN). All-the-while UBS continues its unabated interstate rampant interstate crimes, especially against UBS retired elderly Florida Client victims. Enjoy and learn.

____________________________

VE1 Salt Lake City, Utah

Salt Lake City, Utah panorama

UBS AG (SWISS) UTAH BLATANT COLLABORATIONS AND FRAUDS UPON THE UTAH STATE & USA FEDERAL COURTS ARE EASILY EXPOSED.

Issue 5 is a Utah & Florida chronology of documented UBS AG (Switzerland) dubious USA Federal Government condoned court procedures as well as fraudulent mandatory regulatory manipulations. Our reliable Utah sources continue to comprehensively investigate this UBS AG solely owned UBS Bank USA Utah Industrial Bank massive swindling, mostly of USA elderly UBS Client victims. It also provides access to various World concerned groups interested in UBS AG lucrative international criminal methods. Zurich is the wealthiest city in the World for a reason.

Let us again be reminded of the UBS sales force mantra of target, solicit, recruit, isolate, control, dupe and loot. This is said to allow the UBS Client to obtain the “UBS perfection experience”. To reap these illicit benefits co-conspirator schemers at UBS Financial Services Palm Beach, Florida offices knowingly illegally shared offices with and intentionally commingled UBS Client victim business with Florida unlicensed illegal Utah UBS Bank USA from 2003 > 2010. When aiding and abetting the targeting of UBS elderly Client Mallard for a mortgage, Utah USA Federally unregulated UBS Bank USA did not have a Florida license or charter to do so. All the while UBS AG was being criminally tried (United States of America v UBS AG Case 09-60033-CR-COHN) a few miles South in Ft Lauderdale. From information and belief, this was common practice throughout every UBS targeted and solicited state between 2003 > 2010 whereby UBS AG Utah UBS Bank USA did banking business illegally across state lines in USA. This instantly made UBS AG and it’s solely owned UBS Bank USA criminally liable to USA Federal Law. We will also see below that parent UBS AG (Switzerland) was on USA Federal parol. UBS AG Chairman Raoul Weil had also at the time escaped from USA Federal Court, Ft Lauderdale, Florida and was hiding out in Switzerland as an escaped fugitive from USA justice.

__________________________________________

UBS AG TRAMPLES USA RULE OF LAW

One of the basic rights allegedly given to every USA citizen is the “inalienable right of due process under the law”. UBS AG (Swiss) joined and created it’s solely owned UBS Bank USA by becoming a member of the USA Federally unregulated Utah Industrial Bank Cartel. UBS Bank USA and it’s aliases used either the Utah 3rd District Court or the USA Federal Court both located in Salt Lake City, Utah. Through the authority of these Courts UBS send dubious demands and complaints rife with misrepresentations to their below mentioned UBS Client victims from other states. Among other things but not necessarily all, UBS Clients were then stripped of their USA inalienable right to “due process under the law” by using well known questionable illicit procedures to diminish UBS Client victims, especially the elderly. The intent was, through USA fraud upon the Utah courts et al, to stop any herein mentioned USA victim recourse. If necessary, UBS then exports the UBS Client victim fraudulent defective case to another USA State or Federal Court as a true and correct Utah foreign judgement. These judgements are taken at face value. Utah Industrial Banks know that rarely is the foreign state procedurally allowed to scrutinize and overrule the misrepresentations of the Utah judgements. This UBS matter is much to important to the World citizenry than perilously ignore the responsibility of not reporting it.

______________________________

UTAH INDUSTRIAL BANK & PENNEY STOCK CARTELS

Among World financial and law enforcement regulators, the USA Utah State is known as the indisputable leader of both USA Federally unregulated Industrial Bank and Penney Stock Cartels. We will only address the USA Federally unregulated Utah Industrial Bank Cartel. In particular, the now defunct Lehman Brothers cartel member and presently active UBS AG (Switzerland) solely owned UBS Bank USA member headquartered in Salt Lake City. Suffice it to say, Lehman and UBS Utah Industrial Banks were substantial perpetrators in the 2008 World stock market crash. This has been purposely hidden from the World so UBS AG could initially receive USA and Swiss Government bailouts and continue the UBS AG reign of terror primarily against UBS Client victims, especially the elderly and women. We have the corroborating documents, testimony and reliable sources. Use your computer search engine to look up the most recent UBS swindle of Puerto Rican elderly UBS Clients. We have a paper trail going directly to the UBS Americas Chairman’s desk in New York on the UBS perpetrated Puerto Rico bond scandal. Sadly, we also report on USA vulture funds following UBS to pick up the swindling remnants.

Other USA international banks based in New York are following Lehman & UBS AG to Utah by creating USA Federally unregulated Utah banks. There is no USA Federal Reserve accountability by the Utah Industrial Bank Cartel members. Furthermore, the Utah Industrial Bank Penny Stock Cartel members receive favorable treatment in both the massive Salt Lake City 3rd District and Federal Courts, among other things. A reliable USA CEO source who went through the Utah Industrial Bank Cartel ritual admission requirements told us of the procedures and perks available to the membership supersede Federal and other State Bank regulations. Prospective members are told there standing is directly related to Utah community events donations. We will see herein UBS is the #1 giver of money to the Utah Symphony with the Latter Day Saints Church (Mormon) #2.

________________________________________

SALT LAKE CITY, UTAH PENNY STOCK FRAUD CAPITAL OF WORLD

Deseret News (Utah) reports: “Utah’s unsavory reputation for swindles has spread nationwide. Former Colorado Securities Commissioner Royce Griffin said … Penny stock fraud has flourished in Salt Lake City since Utah’s earliest mining days, said State Securities Division Director John Baldwin. … another trend is for companies formed in Utah to have their stock sold through brokers in Europe to victims all over the world. … regulators in the state, around the country and abroad are learning to cooperate in the fight against penny stock fraud, officials say. Multiagency approaches have been used in several recent investigations of Utahns and Utah-related companies. “ VE1-1

____________________________________________

UTAH “SEWER” OF USA SECURITY INDUSTRY CRIMES!

Cleveland Independent Media reports: “There’s a good reason Salt Lake City is by far the smallest city where the U.S. Securities and Exchange Commission set up an office to fight fraud.… The flogging of worthless penny stocks earned Utah a reputation as the sewer of the securities industry. It has yet to fully shake the tag. … Now, fraud runs the gamut from old-fashioned Ponzi investment schemes that amaze Israel with their frequency–“we see a ton of those cases”–to modern Internet and identity thefts. Some days, the business page of the Salt Lake newspapers reads like a police blotter. … the Church of Jesus Christ of Latter-day Saints [Mormon] is not involved, but its close-knit structure provides a handy bunco incubator. Indeed, when Israel has to consult Mormon authorities on swindlers claiming church connections or business, the leaders are eager to cooperate.” VE1-2 It is very difficult to indeed believe that the State of Utah and Mormon religion can have such commendable international political figures as Orrin Hatch, John Huntsman, Mitt Romney and Jason Chaffetz while turning a blind eye and deaf ear to known USA Federal and international criminal activities herein mentioned.

________________________________

UTAH IS KNOWN BY WORLD FINANCE AS SECURITIES FRAUD CAPITAL OF USA.

Utah CEO Magazine reports: “Along with Mormons and the 2002 Winter Olympics, Utah is known for securities fraud. ‘For good or for bad, deserved or undeserved, Utah has a national reputation for being the center of securities fraud,’ notes Kevin Timken, a securities attorney at Kruse Landa Maycock & Ricks, LLC (KLM&R). ‘In fact, Utah is the smallest state to have its own office of the Securities and Exchange Commission.’ …Both federal and state laws have provisions that say that it is unlawful to sell securities with a material misstatement or omission of a material fact. … You must be both accurate and complete,’ … failure to comply with applicable securities laws could result in … and possibly criminal charges as well as civil lawsuits from investors seeking damages and a return of invested money.” VE1-2-1

__________________________________________

WHEN WILL FEDERALLY UNREGULATED UTAH INDUSTRIAL BANKS BE SHUT DOWN?

Salt Lake Tribune reports: “Obama is calling for the elimination of industrial bank charters and wants them all shut down within five years. If successful, the president’s plan could deal a hammer blow to Utah’s economy, which is the home of 25 industrial banks that employ thousands of the state’s residents and hold assets valued in excess of $168 billion. … Although Ed Leary, commissioner of the Utah Department of Financial Institutions, pointed out the administration’s plan is only preliminary and there is not yet any legislation before Congress. Nevertheless, he said, the proposal was disheartening. ‘It is discouraging they would want to eliminate a charter [for industrial banks] that has never caused problems and didn’t contribute to any of the country’s financial problems,’ Leary said.” VE1-3

__________________________

UTAH INDUSTRIAL BANKS TO BE SHUT DOWN!

New York Times reports: “Utah is the nation’s unlikely capital of industrial banks — niche institutions that primarily make loans to businesses. Corporations like Goldman Sachs, Target and General Electric have been attracted to the state to set up such institutions. While they have brought billions of dollars in deposits, thousands of jobs and millions in charitable donations to Salt Lake City, the banks have also drawn fire from Washington. … Treasury Secretary Timothy F. Geithner and other officials are pressing ahead with their proposal to require the institutions to submit to Federal Reserve oversight, part of a sweeping package of regulatory reforms. But the battle over the banks, expected to intensify now that Congress is back in session, demonstrates how difficult enacting tougher regulation can be. … Unlike commercial banks, though, all but the smallest industrial banks are barred from offering checking accounts, so most have no retail branches. And they are not supervised by the Federal Reserve nor are their parent companies required to set aside capital reserves that could be used if a bank gets into trouble. … But critics tick off a list of complaints about the banks, including assertions that owning them gives their corporate parents an unfair advantage and encourages risky practices. … In addition, he and others point out, state regulators and the F.D.I.C. do not have the same powers as the Federal Reserve to demand changes in risky business practices by parent companies that might indirectly threaten their industrial banks. … Treasury officials have not blamed industrial banks for a role in the financial crisis, but they do argue that the regulatory loophole permitted abusive actions by some of their parent companies that fed the problems. … ‘The United States of America has lost billions of dollars based on inadequate regulation,’ said James A. Leach, a former Republican congressman from Iowa and longtime critic of industrial banks. ‘Once you set up an exception like the industrial bank charter, the smart and the big are not dumb. They will exploit it. And that is just what they did.’ ” VE1-4 USA Presidential Team UBS has been using their Cabinet Secretaries to buttress up UBS AG through questionable policies. Let us be reminded, Clinton/ Bush II/Obama continue to receive deferred payments from UBS, among other things.

_________________________________________

ARE USA FEDERALLY UNREGULATED UTAH INDUSTRIAL BANKS STILL DANGEROUS FOR WORLD FINANCIAL STABILITY, AFTER 2008 WORLD FINANCIAL CRASH?

American Banker reports: “ILC [Utah Industrial Banks], a type of charter that allows companies to own a bank without having to comply with [USA Federal] Bank Holding Company Act requirements and face supervision by the [USA] Federal Reserve Board. … Community banks and others who support a strong firewall between banks and commercial firms … Camden Fine, the president and CEO of the Independent Community Bankers of America. ‘If these entities want to be banks, they should apply for banking charters and come under full and unified banking supervision.’ … ILCs are a window into the banking system for nontraditional financial institutions seeking to access the [USA] Federal Reserve payments system and take deposits, which are a cheap source of funding for loans. … said Fine. ‘Congress is going to have to address this issue. Do they want a commercial banking system regulated uniformly or do they not? That’s the question they are going to have to grapple with.’… The ILC is a controversial bank charter that critics say creates a loophole to the separation of banking and commerce, allowing firms to skirt Fed supervision. Supporters of the charter note that ILCs have been regulated successfully for decades by the FDIC [Federal Deposit Insurance Company] and the states, including Utah”. VE1-5 UBS AG (Swiss) solely owned UBS Bank USA and Lehman’s Bank as USA Federally unregulated Utah Industrial Banks were considerably responsible for the chain of events leading to the World 2008 financial crash. Perplexingly, USA Senate Finance Chairman quit Congress and immediately became UBS Vice Chairman. UBS Bank UBS was also USA Federal and State illegally doing interstate business in USA States out of UBS Financial offices without a mandatory State license to do so in any State but for Utah. UBS was pushing downgraded Lehman’s stocks onto unknowing UBS elderly clients. At this time Bush II Treasury Secretary Paulson met with his Goldman Sachs prior associates in a Moscow Marriott Hotel room. Lehmans was then allowed to fail while UBS was given an indirect Bush II USA Federal bailout. We have seen a rendition of this massive UBS swindle in Puerto Rico with questionable bonds coerced by UBS upon UBS elderly clients just before the Puerto Rican bond crash.. In the Puerto Rico UBS swindle crash the UBS paper trail went directly to the UBS Chairman’s desk.

__________________________________

United States Supreme Court says cartels are: “the supreme evil of antitrust.”(1) Prosecuting cartel offenses continues to be the highest priority of the United States Department of Justice’s Antitrust Division.(2) The Antitrust Division has sole authority for federal criminal antitrust enforcement in the United States.” VE1-6

_________________________

DID UBS FURTHER “INCENTIVIZE” PRESIDENT OBAMA BY INCREASING HIS DEFERRED PAYMENTS SO HE WOULD REFUTE HIS CAMPAIGN PROMISE OF TERMINATING THE USA FEDERALLY UNREGULATED UTAH INDUSTRIAL BANKS?

New York Times reports: “Utah is the nation’s unlikely capital of industrial banks … While they have brought billions of dollars in deposits, thousands of jobs and millions in charitable donations to Salt Lake City, the banks have also drawn fire from Washington. … The Obama administration argues that the banks pose a threat to the economy because their parent companies can engage in risky practices but are often exempt from routine scrutiny by the Federal Reserve. … Unlike commercial banks … they are not supervised by the Federal Reserve nor are their parent companies required to set aside capital reserves that could be used if a bank gets into trouble. In Salt Lake City, the banks have been a welcome presence. They created an estimated 15,000 jobs at the banks and related service companies, and their executives have sprinkled money around to everything from the Utah Symphony Orchestra to housing for the poor.But critics tick off a list of complaints about the banks, including assertions that owning them gives their corporate parents an unfair advantage and encourages risky practices. In addition, he [Obama] and others point out, state regulators and the F.D.I.C. do not have the same powers as the Federal Reserve to demand changes in risky business practices by parent companies that might indirectly threaten their industrial banks. Treasury officials … have not blamed industrial banks for a role in the financial crisis, but they do argue that the regulatory loophole permitted abusive actions by some of their parent companies that fed the problems. ‘This is not about picking on anyone, but they contributed to risk in the system,’ said a Treasury official, who spoke on condition of anonymity because he was not authorized to comment on the issue.” VE1-7

___________________________________________

WORLD CRIMINAL SCHEMES THOUGHT TO BE PERPETUATING USA FEDERALLY UNREGULATED UTAH INDUSTRIAL BANKS.

New York Times reports: “A few industry observers go further in their complaints. Some companies intentionally chose an industrial bank charter — where they could raise money through brokered C.D.’s, investor funds in cash accounts and funds from business clients — so that they could take riskier bets and have higher leverage in their other business units, argued Raj Date, who leads a nonprofit industry research group, Cambridge Winter. He said that parent companies of eight of what had been the top 12 Utah industrial banks filed for bankruptcy protection or received large allotments of federal bailout funds or other federal financial support in the last year. Those companies … consumed $70 billion, according to Mr. Date’s analysis. (Those institutions have all closed their industrial banks, in most cases a condition of accepting the money.) ‘The United States of America has lost billions of dollars based on inadequate regulation,’ said James A. Leach, a former Republican congressman from Iowa and longtime critic of industrial banks. ‘Once you set up an exception like the industrial bank charter, the smart and the big are not dumb. They will exploit it. And that is just what they did.’ ” VE1-8 The lengthy New York Times article is self explanatory. We now see not only UBS AG Switzerland solely owned Utah Industrial Bank cartel member UBS Bank USA but Goldman Sachs became Utah USA Fedrally unregulated before the next World financial crash.

____________________________________

USA 2018 STOCK/BOND MARKETS ARE GETTING WEIRD LIKE UBS/LEHMAN UTAH FEDERALLY UNREGULATED UTAH INDUSTRIAL BANK CARTEL 2008 OMENS.

CNBC reports: “There’s something weird going on that’s worrying the markets The yields of longer duration bonds are getting closer to the yields of shorter duration bonds, and some see that as a forewarning about a slower economy.… There’s an odd chill in the air on Wall Street, but many analysts are shrugging it off as a temporary cooling of a market that still has room to run.” VE1-9 In 2008 It was Utah Federally unregulated Utah Industrial Banks Lehman & UBS. 2018 IT ID UBS, Goldman Sachs & Chase Morgan! This should be dumbfounding to the World.

_____________________________________

WHY DOES USA FEDERAL GOVERNMENT ALLOW UTAH INDUSTRIAL BANK & PENNEY STOCK CARTELS TO EXIST?

The USA Federally unregulated Utah Industrial Bank cartel has been allowed to continue to exist within the USA long after USA antitrust laws were enacted, for some reason. This has caused undue harm to USA banking by giving Utah Industrial Banks unfair competitive advantages over other USA and international banks. Again, Utah Industrial Bank cartel members UBS and Lehman were instrumental in initiating the 2008 World Financial crash.

There are known and unknown reasons why Utah Industrial Bank and Penney Stock cartels are allowed to continue existing, while conflicting with USA Supreme Court Antitrust rulings. Among other things but not necessarily all, it is known that both have created windfall in profits for Utah Federal and State Court systems, Utah lawyer/lobbyists as well as other Utah related peripheral businesses.

__________________________________

Salt Lake City, Utah Temple surrounded by law offices representing USA unregulated Utah Industrial Banks & Penny Stocks Cartel members.

SALT LAKE CITY, UTAH DECEPTIVE PANARAMA

One only has to look at the foyer index names to see the inordinate number of Salt Lake City, Utah buildings stuffed with Utah law firms serving Utah Industrial Bank and Penny Stock Cartel members. The parapets in the middle of this panorama are of the World renown Mormon Temple surrounded by Church administering worldwide offices. Across the street from the Temple is the exclusive private Alta Club for, among other things but not necessarily all, Utah lawyers profiting from cartel swindles.

____________________________________________

UBS AG AS UTAH INDUSTRIAL BANK CARTEL MEMBER OWNER IS #1 MONEY GIVER TO UTAH SYMPHONY. #2 IS THE LATTER DAY SAINTS (MORMON) CHURCH.

UBS frequently gives money to wealthy community events. This allows their stockbroker salesforce to target, solicit and recruit unsuspecting Clients. Many do not know the UBS AG (Swiss) international reputation herein exposed. In Salt Lake City, Utah UBS is more interested in being seen as a good Utah Industrial Bank Cartel member in order to get the highest Cartel State and Federal Court system preferential treatment. We will see this enacted through exposing many Court misdeeds perpetrated upon sundry UBS Client victims. In all of the UBS and Lehmans cases there was never a case when UBS was not favored over UBS Client victims, especially the elderly. We will cover many of the UBS perpetrated frauds against UBS Client victims .

___________________________________________

FDIC IS A PRIVATE INSURANCE COMPANY AND NOT A USA FEDERAL GOVERNMENT AGENCY.

Lehman Brothers Commercial Bank Salt Lake City, Utah

Application for Federal Deposit Insurance

(Bank Insurance Fund)

ORDER: The undersigned, acting on behalf of the Board of Directors pursuant to delegated authority, has fully considered all available facts and information relevant to the factors of Section 6 of the Federal Deposit Insurance Act relating to the application for Federal deposit insurance for Lehman Brothers Commercial Bank (the Bank), a proposed new Utah industrial bank to be located at 4001 South 700 East, Suite 410, Salt Lake City, Salt Lake County, Utah, and has concluded that the application should be approved.

Dated at Washington, D.C. this 10th day of August 2005.

FEDERAL DEPOSIT INSURANCE CORPORATION

By: Lisa K. Roy

Associate Director

Division of Supervision and Consumer Protection

_____________________________________________

FDIC IS A PRIVATE INSURANCE COMPANY AND NOT PART OF THE USA FEDERAL GOVERNMENT.

UBS Bank USA

Salt Lake City, Utah

Application for Federal Deposit Insurance

(Bank Insurance Fund)

ORDER: The undersigned, acting under delegated authority, has fully considered all relevant facts and information relating to the factors of Section 6 of the Federal Deposit Insurance Act regarding the application for Federal deposit insurance for UBS Bank USA, a proposed new bank to be located at 299 South Main Street, Suite 2275, Salt Lake City, Salt Lake County, Utah, and has concluded that the application should be approved.

Dated at Washington, D.C. this 9th day of September, 2003.

FEDERAL DEPOSIT INSURANCE CORPORATION

By: Lisa K. Roy

Associate Director

Division of Supervision and Consumer Protection

________________________________

UBS AG SOLELY OWNED UTAH UBS BANK USA ILLEGALLY DID BUSINESS IN FLORIDA FROM 2003 > 2010 WHILE ON USA FEDERAL PAROLE AND CONTRARY TO USA FEDERAL REINVESTMENT ACT. USA AG STILL KEEPS ITS USA CHARTER, SOMEHOW!

Buzzfeed reports: “Insurance Act relating to the application for Federal deposit insurance for Goldman Sachs Bank USA (the Bank), a proposed new Utah industrial loan corporation to be located at 295 Chipeta Way, Salt Lake County, Utah, and has concluded that the application should be approved. … ‘A lot of parent companies [UBS, GOLDMAN SACHS] do not want to [be] regulated or supervised by the federal reserve,’ Jim Barth, … fellow at the Milken Institute, told BuzzFeed News. … There is also the issue of the Community Reinvestment Act, which requires banks to meet the credit needs of all the consumers in the places where it does business … John Taylor, president of the National Community Reinvestment Coalition, worries that ILCs can get banking charters without the same obligations to make credit widely available — and this position has made him a strange bedfellow of banking lobbies. The ILC applicants “want to have access to the resources banks have,” said Taylor. And to him — and some banks — this raises concerns “about safety and soundness and lack of regulatory oversight that could create malfeasance.” VE1-10 UBS sales force mantra of target, solicit, recruit, isolate, control, dupe and loot has been used upon many Florida UBS elderly account assets (see issue 4). UBS criminally ignored the Community Reinvestment Act in order to curtail the needs of UBS Clients.

_______________________________

USA vs UBS AG

USA vs UBS AG CHAIRMAN RAOUL WEIL

UBS AG USA IS CRIMINALLY PAROLED IN USA FEDERAL COURTS BUT UBS IS ALLOWED TO KEEP THEIR USA CHARTER.

UBS AG (Zurich, Switzerland) is the sole owner of the Utah Industrial Bank and its aliases UBS Bank USA, UBS Bank and Bank UBS. The UBS AG [Switzerland] solely owned UBS Bank USA from it’s creation September 15, 2003 to present has continually committed documented crimes upon USA Federal & State Governments, USA citizens and the World. There is a chronology of known UBS AG continuing USA Federal criminal violations occurring while on and off USA Federal criminal parole (Exhibit X & PPPPP). Among other things but not necessarily all, USA AG knowingly continues to misrepresent it’s UBS Bank USA as USA Federally regulated within World court submissions and international advertisements, somehow.

_____________________________________________

AGAIN, UBS AG SOLELY OWNED UTAH INDUSTRIAL BANK “UBS BANK USA” AND IT’S ALIASES HAVE ONLY BEEN UTAH STATE CHARTERED IN USA FROM 2003 > 2010.

“Holden [owned] By: UBS AG [Switzerland] Charter Class: [USA] Commercial bank, state charter and Federal nonmember, supervised by the FDIC”

Again, UBS AG wholly owns the UBS Utah Industrial Bank and it’s aliases UBS Bank, UBS Bank USA et al are only members of the Utah industrial Bank cartel “Commercial bank, state charter and Fed nonmember” (above Exhibit UUUU). UBS AG purposefully continues to successfully misrepresent the truth in USA State and Federal Courts by saying Utah UBS Bank USA is a USA Federally chartered bank.

___________________________________________

UBS Bank USA headquarters with solicitation cubicles.

299 South Main Street, Suite 2275 cubicles

Salt Lake City, Utah 84111

UBS WORLD LOGO GRAFFITI BLIGHT!

UBS has a penchant for putting its logo on the sides and tops of buildings throughout the World when in fact it rents just a few guarded solicitation and recruiting cubicles. The suite is always on a above secure floor in secure buildings. Throughout the World UBS AG is frequently attacked by angered UBS Clients. The UBS logo is turning into World graffiti defacements.

___________________________________________

UTAH DEPARTMENT OF FINANCE CONTRADICTS UBS AG BY TELLING THE TRUTH.

Utah Department of Financial Institutions in 2014 writes the truth in explaining that: “All industrial banks (IBs) [herein Utah Industrial Banks] are chartered by the state [herein Utah]. Nationally or federally chartered IBs do not exist.”

____________________________________________

UBS AG (SWISS) FALSIFIES STATEMENTS WITHIN IT’S UBS BANK USA 2017 MANDATORY SUBMISSIONS. THESE FRAUDULENT DOCUMENTS WERE THEN GIVEN TO UTAH DEPARTMENT OF FINANCE, USA FEDERAL RESERVE, USA GOVERNMENT AND THE WORLD AS TRUE AND CORRECT. UBS AG WAS THEN ALLOWED BY OBAMA TO KEEP IT’S USA CHARTER, SOMEHOW!

Please note UBS Bank USA in 2017 fraudulently refers to itself as being USA Federally regulated by “Federal Regulator FDIC”. Again, FDIC is an insurance company and not a USA Federal agency. There is nothing as sacrocanct as the integrity of World financial institutions for government and client credibility. UBS AG deliberately with malice fraudulent holds it’s solely owned Utah UBS Bank USA out to the World as a USA Federally regulated bank. These continuing repetitive falsities cannot be construed as mistakes or inadvertences but only deliberate false statements to perpetuate World criminal acts. Federal Deposit Insurance Company is not either part of the USA Federal Reserve or any USA Government Agency. FDIC is an insurance company. This statement should be construed as yet another criminal violation perpetrated by UBS AG (Switzerland) upon USA Federal Government, USA citizens and the World. Again, when will UBS loose it’s USA Charter?

______________________________

UTAH INDUSTRIAL BANK CUBICLES

These Utah Industrial Bank & Penny Stock cubicles typify the Utah headquarters office operations look since almost all communications is via phone or computer with lawyers, out of state client victims or the designated Salt Lake City 3rd District State or Federal Court.

_________________________________

UTAH INDUSTRIAL BANKS PHYSICALLY RESEMBLE WORLDWIDE CREDIT COLLECTION AGENCIES.

One is initially alarmed that Utah Industrial Banks physically do not resemble other USA State or USA Federally regulated Banks. There are few client friendly areas with tellers, customer windows or anything resembling a bank within their headquarters and usually sole office. It looks more like rows of collection agency kiosks containing one chair, elaborate headsets with professional speaker/ear phones and a desk computer. There were several attempts to take a picture of the kiosks at the front door with a client but bank officers refused to allow it. We were informed kiosk conversations are usually between foreign corporate owners, lawyers, Salt Lake City 3rd District or USA Federal Courts and Client victims. Clients for the most part are out-of-state UBS Client elderly victims whose life savings are fraudulently exported, usually to Salt Lake City 3rd District Court. In essence, Utah Industrial Banks are not client friendly places inside. They are allegedly predatory corporate collection agencies insinuating fake demands upon far off client victims. All of the above fraud is done with the use of interstate communications subject to USA Federal law. Obfuscations to USA law & order have come directly from “USA Presidential Team UBS” in consideration for deferred payments.

__________________________________________

USA FEDERALLY UNREGULATED UTAH INDUSTRIAL BANK CARTEL WASHINGTON LOBBYISTS

New York Times reports: “The lobbyists for Utah Industrial Banks Douglas S. Foxley, left, Frank R. Pignanelli, right, and George Sutton, middle, a former Utah regulator, say industrial banks are among the safest and do not need Federal Reserve oversight. They have gained powerful supporters in Washington.” VE1-11 These facially descriptive Utah lobbyists represent the Utah Industrial Bank Cartel in Washington. These depicted men represent typical looking Washington lawyer/lobbyists.

__________________________________

UTAH INDUSTRIAL BANK’S PIGNATELLI SPEAKS!

UTAH INDUSTRIAL BANK’S PIGNATELLI SPEAKS!

Frank Pignanelli says: “Industrial banks are the safest and soundest institutions in the country. In terms of capital and everything else, they are safe and sound. Lehman burned to the ground. What was the one asset left standing? Their industrial bank.” Pignantelli blithely does not take into account that World consensus is both UBS AG’s UBS Bank USA and Lehman’s Woodlands Bank USA Federally unregulated banks were instrumental in causing the 2008 World financial crash.

Frank Pignanelli speaks, again!! UBS gives to Utah Symphony.

_____________________________________

TESTIMONY OF GEORGE SUTTON, ESQ AS HE SPEAKS ON BEHALF OF THE SECURITIES INDUSTRY ASSOCIATION BEFORE THE USA HOUSE FINANCIAL SERVICES SUBCOMMITTEE ON FINANCIAL INSTITUTIONS AND CONSUMER CREDIT!

Utah lawyer/lobbyist George Sutton’s speech is filled with misrepresentations of the truth. Lobbyist Sutton’s talk was still accepted by USA House Financial Services Subcommittee as true and correct, somehow. Callister, Nebeker and McCullough in Salt Lake City, Utah is considered the most powerful lawyer/lobbyist firm in Utah.

_________________________________________

UBS AG (SWISS) & LEHMAN SOLELY OWNED USA FEDERALLY UNREGULATED UTAH INDUSTRIAL BANKS IMPLICATED IN 2008 WORLD FINANCIAL CRASH.

Salt Lake City Weekly reports: “The state of Utah and the lobbying firm Foxley & Pignanelli have become the largest cheerleaders for this arm of the banking industry [Federally unregulated Utah Industrial Banks], which according to Frank Pignanelli—a lobbyist, executive director of the National Association of Industrial Bankers and former Democratic legislator … In addition to benefits derived from corporate ownership, industrial banks enjoy another perk: being exempt from the Bank Holding Company Act. By operating outside of the act, the parent companies of industrial banks aren’t regulated by the Federal Reserve. Instead, the FDIC and, largely, Utah’s Department of Financial Services, regulate them. … Darryle Rude, chief examiner with the Utah Department of Financial Institutions, says that state regulation is “less onerous” than federal oversight. … While there might be some tangible benefits to keeping the Federal Reserve off of a bank’s back, according to George Sutton, former commissioner of the Utah Department of Financial Institutions, lack of oversight by the Federal Reserve is not what fueled the growth of these banks. … National banking associations and even the Federal Reserve raised this concern, contending that the inability of federal watchdogs to regulate parent companies of industrial banks presented a “blind spot” that, if left unchecked, could rain chaos on the nation’s financial sector. … In testimony before the House Subcommittee on Financial Institutions and Consumer Credit in July 2006, Scott G. Alvarez, general counsel of the board of the Federal Reserve, said the rapid expansion of industrial banks created a potentially unfair opportunity for corporations to gain access to the federal banking safety net. … ‘If Congress does not address the ILC exception, the nation’s policies on banking and commerce and the supervisory framework for corporate owners of insured banks are in danger of being decided for Congress through the expansion of this loophole by individual firms acting in their own self-interest,’ Alvarez said. … ‘One example of this was Lehman Brothers, which up until 2011, operated a Utah industrial bank called Woodlands Commercial bank. Even as Lehman Brothers went belly up, Woodlands slowly self-liquidated, inching down from a 2008 peak of $6.8 billion in assets to $1.6 billion before closing for good in 2011.’ … One of the laws that Pignanelli says nearly found its way into the document would have placed an outright prohibition on the charter, driving a stake through industrial banking’s heart. Sutton was one of those lobbying on behalf of industrial banks. ‘We were able to head off all of the legislation that would have permanently eliminated the charter,’ he says. … Howard Headlee, president of the Utah Bankers Association, says his counterparts across the country [World] were acting out of fears surrounding an industry that they knew nothing about.” VE1-12 It should be considered troublesome to World finance when Lehman was bankrupted while UBS was given a questionable backroom USA/SWISS bailout. There was also a successful unilateral documented scheme by UBS to insinuate Lehman’s shoddy almost worthless shares to replace quality shares in UBS elderly USA victims accounts. UBS salesmen used such words as vomit, shit and other vulgar words to refer to the Lehman’s stocks they were dumping into the accounts of the unsuspecting USA elderly UBS client victims. The above Utah lawyer/lobbyists men are said to have a stranglehold upon Washington financial committee’s revolving door that partially caused the World 2008 financial collapse. A desperate UBS AG is said to be heading in that direction again.

_________________________________

ARE INTERNATIONAL BANKERS QUIETLY MOVING TO UTAH INDUSTRIAL BANKS FOR WINDFALL PROFITS DURING THE FORTHCOMING WORLD FINANCIAL CRASH?

Telegraph reports: “One of Britain’s top fund managers, who correctly predicted the recent share sell off, has said that it was only a taster, and that he is confident an ‘earthquake’ will hit markets ‘within months’. … Jonathan Ruffer, who oversees billions of pounds of savers’ cash and has a personal fortune of around £400m, was last year revealed to be the mysterious buyer of $200m worth of insurance to protect his portfolio from a rise in the volatility of American shares.” VE1-13

______________________________________

WHEN WILL PRESIDENT TRUMP DRAIN THE WASHINGTON SWAMP? WILL PRESIDENT TRUMP FINALLY REVOKE UBS AG USA CHARTER?

It has been amusingly said the above lobbyist picture depicts typical self-important lobbyist/lawyers that President Donald Trump wants to drain from the Washington swamp. These men lobbying for the Utah Industrial Bank cartel are typical of “deep state” members by wanting status-quo to continue in Washington. These men typify Washington lawyer/lobbyist prototypes for Hollywood central casting. Lobbyists are lawyers so they can declare fiduciary relationship when asked to give testimony against clients. Self-importance and “deep state” mentality is generally a requirement for lawyer/lobbyists lurking in the hall corners and other recesses of Washington Congress. This is especially true near the Ways & Means and Finance Committees because that is where the money allocations are implemented. Watching the lawyer/lobbyists at work is not part of the Congressional public tour. Citizens touring the USA Capitol are not allowed to enter corridors, coat rooms et al where lawyer/lobbyists do business for fear the USA public will see reality.

________________________________

UBS AG (SWITZERLAND) SOLE OWNER OF UBS BANK USA UTAH INDUSTRIAL BANK REPEATEDLY LIES TO THE WORLD IN GOOGLE AND OTHER ADVERTISING. UBS AG IS STILL ALLOWED TO KEEP IT’S USA CHARTER, SOMEHOW!

UBS AG (Switzerland) as sole owner of Utah UBS Bank USA repeatedly, successfully avoids USA Federal prosecution while purposefully continuing to misrepresent the truth by saying: “UBS BANK USA is a federally regulated Utah industrial bank.” It is not USA Federally regulated. FDIC is an insurance company and by UBS calling it part of USA Government is defrauding World UBS Clients that rely upon it as being true and correct.

____________________________________________

A joyous David Shulman as UBS Global Municipal Securities Chief.

UBS AG (Swiss) Global General Counsel David D Aufhauser fidgeting!

UBS GENERAL COUNSEL & UBS GLOBAL SECURITIES CHIEF AVOID USA JAIL FOR THEIR USA FEDERAL CRIMES, SOMEHOW!

New York Times reports: “Mr. (David) Shulman, UBS’s global head of municipal securities, who was publicly criticized by Mr. Cuomo, paid $2.75 million to settle the charges and was suspended as a securities broker for two and a half years. Another, David D. Aufhauser, UBS’s general counsel, paid $6.5 million and was barred from practicing law in New York for two years. Mr. Shulman was suspended by UBS and Mr. Aufhauser left the bank. UBS declined to comment on the reason for his departure and named him an adviser to the bank. … Neither man admitted or denied guilt, but in both cases, the allegations made by the authorities were incriminating. According to the complaints, Mr. Shulman sold his personal holdings within days of learning the market was in distress. Mr. Aufhauser was on an Acela train to Washington when UBS’s chief risk officer e-mailed him to warn that the auction-rate securities market was collapsing. Minutes later, he e-mailed his UBS broker to sell the securities in his account. (A lawyer said Friday that Mr. Aufhauser subsequently reversed the trade and didn’t profit from the order.) Today Mr. Shulman is listed as a “managing member” of BasePoint Capital L.L.C., a private investment firm in Greenwich, Conn. Mr. Aufhauser is a partner at the prominent Washington law firm Williams & Connolly. His biography on the firm’s Web site references his experience as “managing director and global general counsel of the UBS AG investment bank.” Both Mr. Shulman and Mr. Aufhauser declined to comment.” VE1-14 We see UBS “decline comment” or renditions thereof over and over in an attempt to silence transparency. We evidence through corroborating documentation that Aufhauser’s UBS AG (Swiss) Global General Counsel office directed the theft of Florida elderly assets, including fraudulent liens/mortgages. Corroborating documents clearly evidence Aufhauser’s office is confirmed to have been directly involved in the UBS 2008 World financial meltdown causes. We see that Aufhauser continues to work for UBS, as UBS “named him an adviser to the bank” immediately after his UBS suspension and being barred from practicing law for two years in New York state. A reliable UBS source has said Aufhauser knows enough to cause UBS to loose their USA Charter hence “advisor” hush money and bluster from Governor Cuomo’s office.

____________________________________________

Prior CIA Director John Brennan

TRUMP REVOKES CIA JOHN BRENNAN’S SECURITY CLEARANCE AND PERHAPS OTHERS TO CURTAIL MONETIZING USA NATIONAL SECRETS AND VITAL INTERESTS.

Fox News reports: “White House Press Secretary Sarah Sanders read a statement on behalf of the president during the start of the press briefing, saying Brennan ‘has a history that calls his credibility into question.’ … ‘The president has a constitutional responsibility to protect classified information and who has access to it, and that’s what he’s doing is fulfilling that responsibility in this action,’ Sanders said … The White House last month accused the former officials of having ‘politicized’ or ‘monetized’ their public service, and said their clearances gave inappropriate legitimacy to accusations with zero evidence.’ ” VE-15 It is has been commonplace among those with USA Government secret clearances to keep them upon retirement to use to monetize their next endeavors. They are then able to speak with active USA secret clearance holders about secrets. This enhances their positions as consultants, lawyers, lobbyists, etc in peddling their secrets discreetly. Revolving door David Aufhauser had security clearance as Treasury Department & UBS AG (Swiss) Global General Counsels as well as Williams & Connolly as a law partner enabled Aufhauser to peddle secrets discretely. At the time Aufhauser was UBS AG (Switzerland) World General Counsel while also a UBS criminal conspirator lightly prosecuted for UBS insider trading. Andrew Cuomo of New York revoked his license to practice law in New York for 2 years. Aufhauser never had a New York license to take away. Obama would take no action against Aufhauser. Perhaps it had something to do with UBS deferred payments Obama was to receive upon Presidential retirement.

_____________________________________________

SENATOR RAND PAUL SUBSTANTIATES TRUMP TERMINATING BRENNAN TOP SECRET CLEARANCE.

Daily Caller reports: “ ‘I applaud President Trump for his revoking of John Brennan’s security clearance,’ Paul said in a press release. ‘I urged the President to do this.’ Paul met with Trump in July to discuss the nullification of the security clearance, claiming Brennan was financially benefitting himself by exposing secret governmental information to the media. … Brennan was hired by MSNBC as a contributor in February, appearing on the network as a frequent critic of Trump. Press Secretary Sarah Sanders explained that certain government officials retain clearance to ‘consult with their successors regarding matters about which they may have special insight,’ and Brennan has not done that.”

Rand Paul reiterates why Brennan lost security clearance, praises Trump for swift action

_______________________________________________

TRUMP REVOKES BRENNAN’S SECURITY CLEARANCE AND PERHAPS OTHERS TO CURTAIL MONETIZING USA NATIONAL SECRETS.

Fox News reports: “White House Press Secretary Sarah Sanders read a statement on behalf of the president during the start of the press briefing, saying Brennan ‘has a history that calls his credibility into question.’ … ‘The president has a constitutional responsibility to protect classified information and who has access to it, and that’s what he’s doing is fulfilling that responsibility in this action,’ Sanders said … The White House last month accused the former officials of having ‘politicized’ or ‘monetized’ their public service, and said their clearances gave inappropriate legitimacy to accusations with zero evidence.’ ” VE1-17 It is has been commonplace among those with USA Government secret clearances to keep them upon retirement to use to monetize their next endeavors. They are then able to speak with active USA secret clearance holders about secrets. This enhances their positions as consultants, lawyers, lobbyists, etc in peddling their secrets discreetly. Revolving door David Aufhauser had security clearance as Treasury Department & UBS AG (Swiss) General Counsels as well as Williams & Connolly as a law partner enabled Aufhauser to peddle secrets discretely. At the time Aufhauser was UBS AG (Switzerland) World General Counsel while also a UBS criminal conspirator lightly prosecuted for UBS insider trading. Andrew Cuomo of New York revoked his license to practice law in New York for 2 years. Aufhauser never had a New York license to take away. Obama would take no action against Aufhauser. Perhaps it had something to do with UBS deferred payments Obama was to receive upon Presidential retirement.

__________________________________________

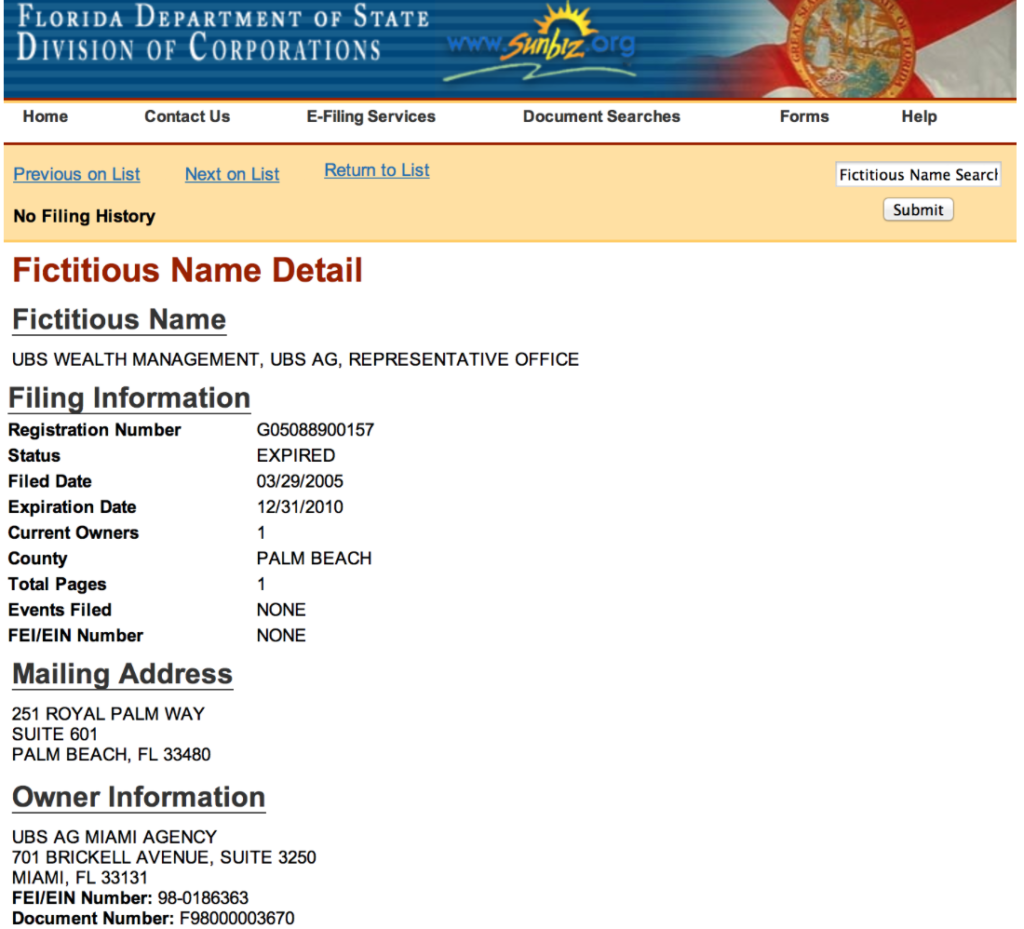

UBS AG SOLELY OWNED UTAH UBS BANK USA OBTAINS FLORIDA CHARTER BASED UPON SUNDRY OVERT LIES, BUT IS STILL ALLOWED TO KEEP IT’S USA CHARTER!

UBS Bank USA filed with Florida Department of State June 10, 2010 criminally stating it was approximately 4 years old when in fact UBS AG (Swiss) sole owner registered it initially 2003 in Utah. Furthermore, Utah UBS Bank USA had been doing business illegally out of UBS Private Wealth Management, 440 Royal Palm Way #300 offices at least since 2003 > 2010. From information and belief Utah UBS Bank USA was also doing business illegally out of UBS Wealth Management offices in all other USA states without being registered with those states.

_______________________________________________

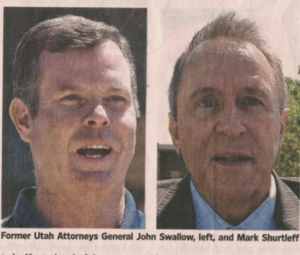

TWO UTAH ATTORNEYS GENERAL ARRESTED FOR REPETITIVE CRIMINAL ACTIVITY!

Wall Street Journal reports: “FBI arrested Utah Attorneys General Swallow & Shurtleff face 23 counts of bribery, tampering with evidence and obstructing justice. … each man could be sentenced to a maximum of 15 years … The pair are accused of trying to cover up their activities by destroying emails and lying to investigators.” VE1-18 Swallow has been an esteemed Bishop within the Mormon Church. All actions against Swallow and Shurtleff were dismissed by the infamous 3rd District Court & USA Federal Courts in Salt lake City. It cannot be found in archives that any lawyers connected to the Utah Industrial Bank or Penney Stock Cartels have ever been successfully prosecuted. They are either Mormons, know too much about the swindling infrastructure or both! It was a given in Utah and Washington Swallow & Shurtleff would be declared innocent. The USA media and public were curious as to how it would be implemented. Was it going to be like UBS AG Group Executive Board Chairman Raoul Weil in Ft Lauderdale, Florida Federal Court (see case at PPPPP below VE1-10) by inundating the marginally picked jury with highly technical bank terms which literally put the jury to sleep , a mistrial, a judicial technicality or some other unknown devious ploy? Swallow was declared innocent by a Utah jury. Swallow then “cried” and thanked the Court. Shurtleff had no jury so was let freed on legal technicalities by the 3rd District Court Judge.

There is too much money to be made in Utah from the thriving Utah Industrial Bank and Penny Stock Cartels through international swindling. Utah Industrial Bank Cartel member UBS Bank USA law firm Anderson & Karrenberg has never been known to have lost a case against UBS Client victims questionably if not illegally transported to Salt Lake City, Utah 3rd District or USA Federal Courts.

_________________________________

UTAH 3RD DISTRICT COURT JUDGE DISMISSES UTAH ATTORNEY GENERAL SHURTLEFF AS DEFENDANT IN CRIMINAL CASES, BY USING “TECHNICALITIES”!

Fox 13 Salt Lake City reports: “The criminal case against former Utah Attorney General Mark Shurtleff is officially over. A judge in 3rd District Court officially dismissed the case Wednesday night, granting a prosecution motion to drop all charges against Shurtleff. … Shurtleff and his successor, John Swallow, faced charges in the state’s biggest political scandal. … Shurtleff and Swallow denied wrongdoing. … The judge signed an order dismissing it without prejudice, meaning that technically, criminal charges could be refiled. However, the statute of limitations on such offenses may be in play.” VE1-19 All USA Federal and Utah case prosecutions against these men could not pass the smell test. These two men knew too much to be convicted. Shurleff had a Washington lawyer/lobbyist firm with Utah Client interests. Swallow was a Bishop in the Morman Church. Both Utah Attorneys General cases did not include other known collaborators. From information and belief, all of the cases against these men were kept smothered so as not to expose any further 3rd District and USA Federal Salt Lake City Courthouse profitable swindle disclosures to the World. In particular, those crimes against USA elderly from other states illegally processed within these two courts by Utah Industrial Bank and Penney Stock cartels. Our University of Utah reliable sources have seen this within UBS Client victims herein mentioned cases.

__________________________________________

Anderson & Karrenberg founding partners.

Anderson & Karrenberg, Utah Law Firm as internationally advertised.

UBS AG UTAH LAWYERS REMAIN A KNOWN ENIGMA.

Anderson & Karrenberg has been a successful albeit sketchy UBS AG Salt Lake City law firm. The John T Anderson identity picture will not be disclosed to the World by other partners. The shadow has been used by Karrenberg and other partners to connote Attorney Anderson for many years, as exactly above presented. John Anderson depiction remains mysterious for a reason. This has never been known to happen in USA law firm partnerships for fear of their reputations and legal actions. What is there to hide? Among other clients but not necessarily all, Anderson & Karrenberg represent UBS AG (Swiss) and their solely owned Utah USA Federally unregulated UBS Bank USA. Anderson & Karrenberg will not give proper documentation on themselves for USA public scrutiny by legal entities like Avvo, Glassdoor or other public interest groups. At least one time USA media has called Anderson & Karrenberg asking for Attorney John Anderson only to be put on speaker then subject to hoots, howls with unmentionables and then told to look somewhere else. How can a law firm do this publicly to a marque partner. We have been told the answer from a reliable Utah source but have a fiduciary confidentiality.

___________________________

The above Defendant Motion was considered the most decisive initiative of the Defendant. Up until that time Defendant was not allowed any Due Process by the Utah Court. This “Memorandum Compelling UBS Compliance with the USA Federal Government by reporting it’s Criminal Violations within this case” took the case into a national venue where similar cases did not reside. ABS AG brought in their UBS New Jersey lawyers to intercede within the Utah Court. UBS had less than two weeks to reply to the Memorandum. Mallard was told that the Court would look more favorably upon his Memorandum if an attorney represented him during the presumed UBS default. After one week Defendant Mallard hired a single youthful practitioner Utah lawyer Daren Levitt. Mallard told Levitt he was only to represent Mallard in Judge Sandra Peuler’s Court during the UBS default proceedings. Mallard gave Levitt the expressed orders that all communications with the UBS New Jersey Riker, Danzig lawyers be either in email or letter form so that Mallard could monitor their behavior. Levitt did not honor Mallard’s request and not only repeatedly spoke to the foreign state lawyers but struck Mallard’s Memorandum without Mallard’s knowledge or consent. Upon investigation by University of Utah law students investigating for distant Mallard, it was found that UBS New Jersey Riker, Danzig lawyers were actually representing UBS AG (Swiss) as sole owner of UBS Bank USA by using the Utah Anderson & Karrenberg law as a front. The New Jersey law firm were repeatedly knowingly practicing law in both Utah Federal & State Courts without a license to do so. Perplexingly, Mallard found UBS Bank USA shoddily answered this June, 2009 Memorandum in November, 2009 or six months later. From information and belief, a University of Utah professor and students independently investigated and submitted this USA Court Compliance to the USA Congressional Judicial Oversight Committee. A respected national senior citizens group and the Comittee are tracking UBS misdeeds through this and internalrevenue.com newsletters.

=====================================

VE2 Palm Beach, Florida

UBS logo on street level left side 440 Royal Palm Way, Palm Beach, FL 3rd floor office is said to have been replaced to avoid vandalism by disgruntled UBS Client victims. Other banks will not talk about it in fear of retaliation from either UBS or UBS demonstrators!

UBS POLICY IS HAVING RENTAL OFFICES ON OR ABOUT 3RD FLOOR OF BUILDINGS FOR SECURITY AND STAFF SAFETY.

UBS logo sign can be seen on the left first floor corner. It has recently been taken down by the building owner for safety reasons! We see in other issue pictures depicting UBS constantly being attacked by angry UBS Clients or prior UBS staff (see issue 2 under VB-12 vandalized Zurich, Switzerland UBS Branch). This has become so dangerous throughout the World that smart building owners are now demanding that UBS logo symbols not be attached to the outside of their buildings. Many other tenants fear their staff may be harmed by angered UBS Clients or frequently fired UBS staff.

_____________________________________________

UBS MAKES FLORIDA DEPARTMENT OF STATE CRIMINAL FRAUD LIST, AGAIN!

UBS Wealth Management did business in Palm Beach, Florida under a “Fictitious Name” while Utah UBS Bank USA alias was doing business without a Florida Department of State license and registration. At the very same time UBS AG, Zurich, Switzerland sole owner of both was being criminally prosecuted and criminally paroled a few miles away in Ft Lauderdale. USA Federal Judge Cohn was assigned three UBS cases (United States of America v UBS Case No. 09-60033-CR-COHN) and two criminal trials of UBS Chairman Raoul Weil (United States v Raoul Weil Case 08-60322-CR-COHN). All-the-while UBS continues its interstate rampant crimes, especially against UBS elderly Florida client victims.

______________________________________

AT ALL TIMES DURING THE MALLARD MORTGAGE NEGOTIATIONS AND COMPLETION WITH ALL PARTIES, INCLUDING UBS, MALLARD WAS REPRESENTED BY ALLEY, MAASS, ROGERS & LINDSEY PALM BEACH LAW FIRM.

amrl .com says: “Alley, Maass, Rogers & Lindsay, P.A. is the largest law firm in the Town of Palm Beach and one of the oldest in Palm Beach County. Raymond C. Alley began representing the Phipps family and their various business interests in Miami in 1925, and moved to Palm Beach County in 1927 when the Phipps family moved”. VE2-1

_________________________________________

ALLEY, MAASS, ROGERS & LINDSAY LAW FIRM DUTIFULLY UPDATE CLIENT MALLARD ON HIS UBS MORTGAGE

There are numerous Alley Maass billings attached to this document, including those pertinent dealings >< between UBS Malissa Smith as UBS representative of Mallard’s UBS Financial Services & UBS Bank USA Florida accounts and Alley Maass attorney Lou Hamby. Again, UBS AG (Swiss) solely owned USA Federally unregulated UBS Bank USA was illegally doing interstate business in Florida from 2003 > 2010 without a Florida Charter to do such. Please note the mortgage creation and transference to the new address of 223 Atlantic Avenue 3E, Palm Beach, Florida 33480.

_______________________________________

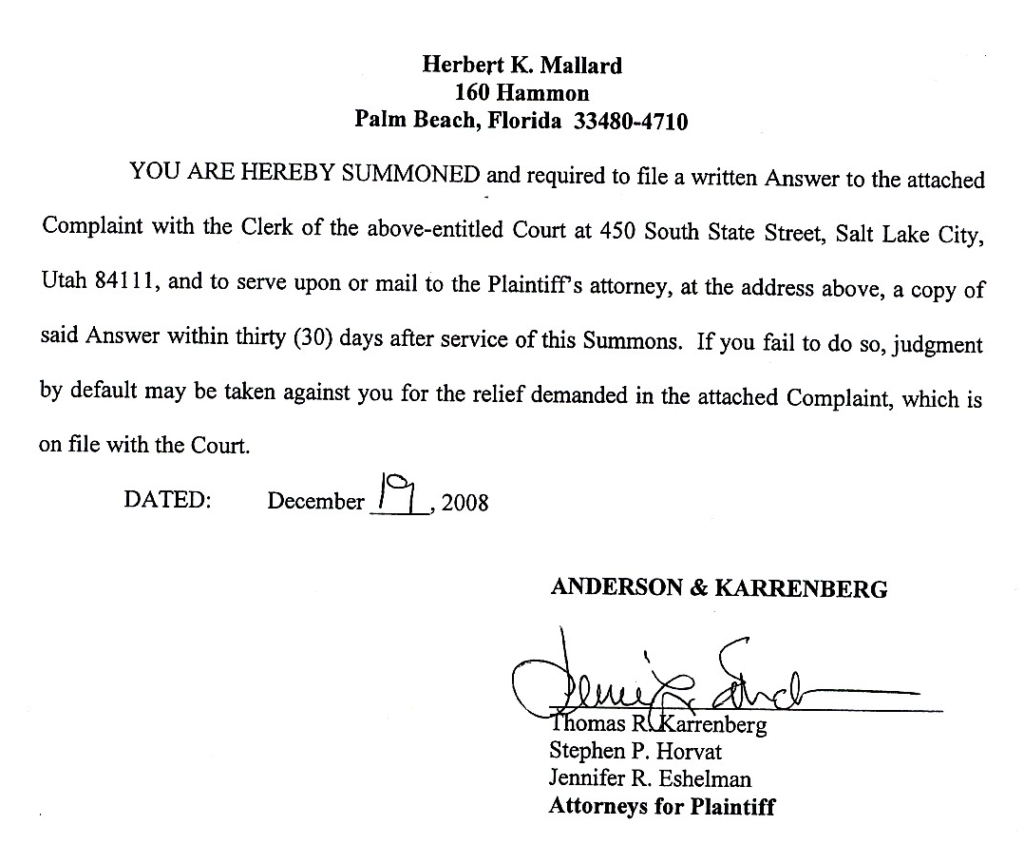

Karrenberg fraudulebt Utah Summons

Exhibit JJJ gramm us personalidentifiers copy

KARRENBERG SENDS AN INTERSTATE FRAUDULENT SUMMONS USING USA FEDERAL POSTAL DEPARTMENT

The above Karreberg Utah Summons was sent to an address that does not exist in the World to UBS advantage. This is yet another clear criminal violation of the USA Federal Gramm-Leach-Bliley Act 15 USC, Subchapter I, Sec. 6801-6809 Disclosure of Nonpublic Personal Information.

___________________________________________

106 Hammon Ave, Palm Beach, Florida 33480

UBS MANTRA OF TARGET, SOLICIT, RECRUIT, ISOLATE, CONTROL, DUPE & LOOT TO ACHIEVE UBS CLIENT “PERFECTION EXPERIENCE”!

Seafront 106 Hammon Ave was Mallard’s residence at the time of his targeting, solicitation, recruitment, isolation and control by UBS. He lived here until moving into his UBS mortgaged 223 Atlantic Ave 3E condominium. Mallard had no idea UBS forged USA Federally mandatory documents in order to gain control of his assets. UBS iterated that the transaction would be incomplete unless all Mallard assets were transferred into the possession and control of UBS. It is now believed this movement was to stop Mallard from further paying Alley, Maass, Rogers & Lindsay to defend Mallard upon the pending duping and complete looting of all Mallard’s uranium and gold mining stocks as well as other assets. Quoted World media within this and other publications depict similar swindles played out time and time again by UBS and their collaborators.

_____________________________________________

UBS CREATED FORGED PROPOSED “KNOW YOUR CUSTOMER” CLIENT RESOURCE ACCOUNT APPLICATION.

Herbert K Mallard (herein Mallard) was targeted and solicited by a Malissa Smith he had known as a local real estate saleswoman who had become a UBS Financial Representative. She said she would work with Mallard’s attorney to create a UBS mortgage with better terms than he was offered by Wells Fargo. Within Malissa Smith’s UBS, 440 Royal Palm Way, Palm Beach, Florida office Mallard was recruited by UBS over Wells Fargo when signing and printing valid name then date and dating the Account Agreement page of the UBS Financial Management Application. At no time was Mallard given the Resource Account Application forged by UBS until UBS Bank USA Utah Court submissions gave a demand letter to Mallard (see above exhibits A & B).

Under Product and Account Ownership Mallard’s Social Security # and address are false and fraudulent. There is no address 160 Hammon in Palm Beach, Florida. It thus cannot be Mallard’s legal address. All of the checked boxes were done by UBS without the knowledge or consent of Mallard. UBS Bank USA Appropriateness and Client Verification were explained by UBS while UBS fraudulently created forged vital information and submitted to Florida, Utah and USA Federal Governments as true and correct.

_________________________________________

UBS AG SOLELY OWNED UTAH UBS BANK USA & UBS FINANCIAL SERVICES INITIATE SWINDLE AGAINST UBS ELDERLY CLIENT MALLARD OUT OF THEIR 440 ROYAL PALM WAY, PALM BEACH, FLORIDA OFFICE.

UBS Bank USA as a USA Government Federally unregulated Utah Industrial Bank cartel member was illegally doing business USA Federally interstate in Florida from 2003 > 2010. Elderly Mallard’s sole intent was to hire highly respected real estate lawyer, Lou Hamby at Palm Beach Alley Maass law firm to expedite the real estate transaction with the 223 Atlantic 3E, Palm Beach, Florida seller and UBS offices at 440 Royal Palm Way, Palm Beach, Florida. Mallard relied upon real estate attorney Lou Hamby’s customary due diligence and scrutiny (see above C exhibit Palm Beach County mortgage registered in UBS favor). All UBS documents known to Mallard were filled out by UBS Palm Beach offices. Unknown documents and entries were later found to contain UBS generated fraudulent Mallard personal identifiers, such as a non-existent address and false social security number sworn to be Mallard’s by UBS.

UBS demanded the real estate mortgage transaction be accompanied by the Mallard transfer all of his stock assets to from nearby Muriel Siebert brokerage office to UBS. Mallard’s UBS assigned representative was Malissa Smith who dealt with real estate attorney Hamby on the intricacies of the real estate. Mallard was introduced to and conversed through three conference calls with Mark Boinavich (sp) of the UBS Real Estate Department, Laurel, New Jersey (866-536-3827). All but the last call to Mark were conference calls were made by Malissa Smith from the UBS Palm Beach offices. Among other things but not necessarily all, UBS Bank USA Palm Beach office started an illegal action at it’s usual 3rd District Court, Salt Lake City, Utah improper venue. According to herein noted Florida law “Section 47.011, Florida Statute provides in relevant part that “[a]ctions shall be brought only in the county where the defendant resides, where the cause of action accrued or where the property in litigation is located.” This section shall not apply to actions against nonresidents.Florida real estate disputes must be heard in the Florida County where the real estate is situated. Unknown to Mallard and presumably Attorney Hamby UBS had appointed Malissa Smith as Mallard’s personal representative even though she was a “UBS TRAINEE”. Some of the Florida violations are disclosed within this Issue while others are book archived.

_______________________________

BROKER SALES TRAINING FOR UBS CLIENT REPRESENTATIVES INTIMATES REWARDS FOR NOT GETTING CAUGHT WHILE A “FORMER” IF CAUGHT.

UBS continues to be indifferent with broker actions. UBS seems to adhere to the Spartan law. If a UBS employee commits a crime and does not get caught they are rewarded by UBS. If the employee commits a crime and gets caught UBS disavows them immediately by saying “former UBS employee”are on their own to defend themselves. Readers only have to read the many herein articles to see examples. Mallard assumed his UBS Personal Representative was not a trainee. Neither UBS nor Malissa Smith ever mentioned her status at UBS. Mallard only met Melissa at her UBS Financial Services, UBS Bank USA et al office before she was replaced as former.

President Obama’s office through Attorney General Eric Holder even introduced a procedure to absolve all senior UBS hierarchy with a slight fine and no prison. This is exactly how UBS AG (Swiss) Global General Counsel David Aufhauser and UBS Global Municipal Securities Chief David Shulman received no prison term for getting caught insider trading. Aufhauser is still considered a lawyer in good standing as a Washington’s lawyer/lobbyist for prior firm as a Williams & Connolly Partner. “USA Presidential Team UBS” continue to collect their deferred payments for allowing such corruption to continue. We have seen many incidents of this duplicitous UBS dubious practice in our published media articles.

President Obama’s office through Attorney General Eric Holder even introduced a procedure to absolve all senior UBS hierarchy with a slight fine and no prison. This is exactly how UBS AG (Swiss) Global General Counsel David Aufhauser and UBS Global Municipal Securities Chief David Shulman received no prison term for getting caught insider trading. Aufhauser is still considered a lawyer in good standing as a Washington’s lawyer/lobbyist for prior firm as a Williams & Connolly Partner. “USA Presidential Team UBS” continue to collect their deferred payments for allowing such corruption to continue. We have seen many incidents of this duplicitous UBS dubious practice in our published media articles.

___________________________________

USA Presidential Team UBS as safety in numbers

USA RACKETEERING ACT & FLORIDA CRIMINAL PRACTICES STATUTE

These USA Federal and Florida state regulations are pertinent to UBS continuing criminal history. Although the “USA Presidential Team UBS” and their collaborators have been aware of UBS criminal activities, there was “a take no action” policy against UBS.

___________________________________

UBS FRAUDULENTLY ADVERTISES TO THE WORLD ON GOOGLE ET AL WHILE ON USA FEDERAL PAROLE BUT KEEPS IT’S USA CHARTER, SOMEHOW!

UBS AG (Swiss) solely owned Utah Industrial Bank UBS Bank USA and it’s aliases fraudulently tell World they are USA Federally Regulated. UBS Bank USA criminally does business at 440 Royal Palm Way, Palm Beach, Florida before 2010 without a Florida Charter or license to do so. As a result of these “misdeeds” UBS has swindled many UBS Bank USA Florida Clients. “USA Presidential Team UBS” has allowed any action to be taken against UBS AG perpetrators or USA administrative state collaborators.

__________________________________________

UBS AG (SWISS) CRIMINALLY IGNORES USA FEDERAL PATRIOT ACT IN NUMEROUS INSTANCES BUT KEEPS IT’S USA FEDERAL CHARTER.

Among other things but not necessarily all, UBS AG (SWISS) through it’s solely owned USA Federally unregulated Utah Industrial UBS Bank USA, UBS Bank and other aliases has done business in Florida and other USA states without a USA State & Federal mandatory license to do so.

UBS Utah Federally unregulated Utah Industrial UBS Bank USA and other aliases conducted business from 2003 > 2010 in Florida without USA Federal or Florida State knowledge or authorization. During this Florida interval and continuance, UBS AG and it’s wholly owned aliases committed heinous corroborated USA Federally un-prosecuted crimes against UBS Clients, especially the elderly. UBS AG’s Utah Industrial UBS Bank USA and UBS aliases has denied any relationship or affiliation with any UBS Financial Services in Florida or other known states.

_________________________________________

UBS FRAUDULENTLY MANIPULATES VITAL USA FEDERAL DOCUMENT SUBMISSIONS OF UBS CLIENT MANDATORY INFORMATION.

Mallard was given the second “ACCOUNT AGREEMENT” page to sign. Mallard never saw, wrote nor properly initialed the “Resource Management Account Application” page. None of the information is in Mallard’s handwriting. Mallard’s USA Social Security is false. Mallard’s address is false. There is no 160 Hammon Ave, Palm Beach, Florida. None of the checked information was written or seen by Mallard. This is not Mallard’s handwriting. It is forged by UBS with false information. In essence, the Mallard vital USA Federal mandatory information was forged by UBS to isolate and control Mallard’s assets. Among other things but not necessarily all, vital USA Federally mandatory information includes a proper address and social security number. UBS AG (Switzerland), as sole owner of Utah USA Federally unregulated Utah Industrial Bank UBS Bank USA, and their lawyers forged Mallard’s vital information. When caught, UBS Bank USA and their Utah lawyers redacted (blackened out) the forgeries from USA Federal Government. Mallard had no comprehension that UBS was swindling him and knowingly submitting fraudulent information to USA Federal Government Agencies.

__________________________________________

Exhibit JJJ gramm us personalidentifiers copy

IT IS A USA FEDERAL CRIME FOR UBS AG OR IT’S WHOLLY OWNED UBS BANK USA TO FORGE UBS CLIENT VITAL INFORMATION

UBS AG (Switzerland) was on USA Federal Government parole with it’s UBS Group Executive Board Chairman Raoul Weil a fugitive USA Justice hiding out in Switzerland when it forged UBS Client Herb Mallard’s vital personal identifiers on mortgage related banking documents. In accordance with USA Federal law these documents were allegedly presented to applicable USA Government Agencies as true and correct. Upon getting caught UBS AG wholly owned Utah Federally unregulated Utah Industrial Bank UBS Bank USA started fraudulently redacting (blackening out) Utah and Florida Courts’ submissions.

______________________________________________

UBS AG SOLELY OWNED FEDERALLY UNREGULATED UTAH UBS BANK USA GENERATED ILLEGAL CLIENT FLORIDA DEPOSIT RECEIPTS.

One of many UBS Bank USA deposit receipts Mallard received from the UBS Bank USA, Palm Beach office. UBS AG (Swiss) solely owned Federally unregulated UBS Bank USA had no charter to do business in Florida at the time of these receipts. UBS AG was committing continuing international criminal offenses.

__________________________________________

Exhibit I UBS Bank USA deposit slip

UBS AG (SWISS) SOLELY OWNED FEDERALLY UNREGULATED UTAH UBS BANK USA ILLEGALLY DID SECRET FOREIGN BANKING OUT OF UBS PRIVATE WEALTH MANAGEMENT OFFICE, 440 ROYAL PALM WAY #300, FLORIDA FROM 2003 > 2010. UBS AG WAS ON USA FEDERAL PAROLE BUT WAS STILL ALLOWED TO KEEP IT’S USA CHARTER BY PRESIDENT OBAMA!

Mallard’s UBS printed UBS Bank USA deposit slips and deposits clearly noting offices at 44o Royal Palm Way #300 shared with UBS Private Wealth Management, etc. Mallard made numerous transactions within this nearby UBS office. UBS Bank USA had neither a license nor a Charter to do business in Florida. UBS Bank USA has denies there existence in Court documents.

__________________________________________

MALLARD TRUE AND CORRECT MORTGAGE SUBMITTED TO PALM BEACH COUNTRY REGISTRY OF DEEDS BY MALLARD LAWYERS ALLEY, MAASS, LINDSEY & ROGERS IN FAVOR OF UBS.

Mallard’s lawyer Lou Hamby of Alley Maass, Rogers & Lindsay law firm submitted this Client Mallard mortgage document as true and correct to the Palm Beach County Registry of Deeds. Alley Maass law firm relied upon UBS submissions, especially vital personal identifiers mandatory for USA Federal Government.

_________________________________________

UBS MORTGAGE DEPARTMENT WAS PURGED WITH TERMINATIONS OF PERSONNEL AND DESTRUCTION OF USA FEDERALLY MANDATED MORTGAGE DOCUMENTS AND CLEAR GROUNDS FOR REVOCATION OF THEIR USA CHARTER.

UBS Client Mallard conversed approximately four times with UBS Mortgage Department officer Mark Boinavich (sp) (herein Mark) from UBS Representative of Malissa Smith’s #300 Royal Palm Way, Palm Beach office by using conference calls. Mallard had signed UBS mortgage documents which Mark had received. During the third conversation Mark sounded shaky. After the third conversation Mallard was asked by Malissa Smith’s alleged supervisor Mr Ludwig to communicate with Mark directly by calling him on his Laurel, New Jersey office land line 866-536-3827. The fourth time Mallard called a few days later using his own home phone as directed by Ludwig. Mallard was told by a female the UBS office was now under control of a “service company”. The cordial woman said the office was in disarray with all UBS personnel gone. She did not know any names, including Marks or their whereabouts. She said shredded documents were everywhere in a complete mess that they were ordered to clean up. Mallard called his attorney Lou Hamby at Alley Maass and mentioned what he experienced. Mallard at the time did not know he had witnessed the aftermath of the destruction of USA mortgages by UBS. Mallard now knows this to be a serious USA Federal crime. Mallard had heard UBS AG had been caught by a night watchman for similar acts in Zurich, Switzerland by burning early in the morning hours what was thought to be Holocaust documents. Soon after, Alley Maass confronted UBS AG (Swiss) Global General Counsel David Aufhauser’s office starting an acrimonious causal chain of events. UBS Client Mallard Representative Malissa Smith called Mallard and asked if he knew Hamby was calling many people up and down the chain of UBS hierarchy. Malissa said the Alley Maass disturbances were causing great anxiety at both the UBS New York and New Jersey headquarters. She told Mallard to shut Hamby up so they could completely reverse what had been done to Mallard. From information and belief, Mallard’s background associations and business acumen was rightly considered to be highly detrimental to the UBS 2008 scheme entirety. We now know UBS AG (Swiss) Global General Counsel Aufhauser’s office was afraid Mallard knew the right moves to implement international exposure. Hamby was considered such a loose cannon that UBS AG (Swiss) Global General Counsel David Aufhauser’s office is believed to have made the decision to crush UBS Client Mallard by converting all Mallard’s assets in UBS AG possession and control to thwart any capability of Mallard from ever fighting back. The Swiss Government allegedly became concerned. A known emissary met briefly with Mallard at his Palm Beach residence. Mallard believes this same Swiss Government official was one of approximately four Swiss men monitoring the prior UBS AG Chairman Raoul Weil’s second Ft Lauderdale questionable trial. They left before the trials ending. Mallard and and media present believed the fake trial was considered finished by the Swiss Government representatives with many mentioning nearby beach time. UBS prior Chairman Raoul Weil attorneys did not even think a Defense rebuttal was necessary. The sleepy jury gave a not guilty verdict abruptly. It was sham theater at best.

_____________________________________

USA FINRA TAKES NO ACTION AGAINST UBS SENIOR STAFF PERPETRATORS IN ROUTINE UBS SWINDLE WHILE ALLOWING UBS TO SACRIFICE STOCK BROKER.