UBS ALLEGEDLY INVOLVED IN FIRST DEGREE FELONY CHARGES AGAINST UBS ELDERLY CLIENT VICTIM

Palm Beach DailyNews reports: “The victim (Helga Marston) suffers from dementia and Alzheimer’s disease, and has been living at the Lourdes Noreen McKeen assisted living facility in West Palm Beach since February 2013. On March 18, 2013, the victim had been evaluated by a doctor, who concluded she had ‘zero’ mental capacity. The doctor said the woman ‘was unaware of her surroundings and described it to be as if she was placed on another planet’. Tsai, 66, is a former interior designer and founder of the Canadian Breast Cancer Foundation. She is the ex-wife of the late billionaire financier Gerald Tsai … Nancy Tsai was booked into the Palm Beach County Jail 1 p.m. Tuesday on first-degree felony charges of exploitation of more than $100,000 from an elderly person and grand theft of more than $50,000 from a person over 65. She was released on a $30,000 surety bond at 8:30 p.m. A call to her attorney, Joseph Atterbury, was not returned by deadline. … (UBS) Financial adviser Dennis T Melchior, Tsai’s boyfriend, acted as broker for the victim’s trust account while employed at UBS Financial Services. He was fired from UBS Palm Beach on April 22, 2013 for failing to tell UBS management of his relationship with Tsai. Although Melchior’s financial broker’s license had been revoked, Tsai added him as an investment adviser to the victim’s trust account and paid him $7,500 monthly since June 2013, according to the affidavit. … Melchior has not been criminally charged. … The police investigation into Tsai was triggered by Financial Industry Regulatory Authority (FINRA) investigation of (UBS financial advisor) Melchior.” H1 UBS Wealth Management Representative Dennis T Melchior was UBS financial advisor to UBS Client victim Helga Marston not his girlfriend Nancy Tsai. It is unknown how many fees or account assets UBS had taken out of UBS Client victim Helga Marston’s estate. It is unknown who told FINRA about UBS Melchior and the UBS operation. FINRA (Financial Industry Regulatory Authority) as the largest private securities regulator in the USA says: “Our chief role is to protect investors by maintaining the fairness of the U.S. capital markets.” From information and belief FINRA is a paper tiger supporting the interests of the regulated like UBS at the expense of the client victims.

UBS Financial Services advisory salesman Dennis T Melchior to UBS Client Helga Marston and his girlfriend Nancy Tsai.

__________________________________________

DOES UBS “INCENTIVISE” UBS SALESMEN TO SIGN USA SENIOR CITIZENS AS CLIENTS, ESPECIALLY WITH DEMENTIA AND ALZHEIMERS?

Bloomberg reports: “Weil gave subordinates at UBS incentives to increase their business with U.S. clients, knowing that they were violating the 2001 agreement to identify customer names, prosecutors alleged in the November indictment. In 2002, Weil and other executives hid from the IRS the results of an internal audit that showed the bank wasn’t meeting the terms of the agreement, according to the November indictment.” H2 Not covered in these media articles is the fact that UBS has not been investigated, prosecuted and gets to keep the elderly UBS Client’s estate looted through the UBS Financial Advisors. Documents were given to an unknowing UBS Client Mallard by UBS showing UBS unilaterally wire transferred offshore his accounts to Switzerland. Mallard and Gardiner accounts are but two with documented UBS offshore statements, shown in this newsletter. If Mahoney is outed he will most probably follow the UBS/FINRA Melchior punishment scam. FINRA will most probably take Mahoney’s license away, UBS will then fire him while UBS will be allowed to escape yet another criminal violation and keep the Gardiner’s Island Family estate loot. Mahoney will yet be another small player victim in the UBS continuing USA criminal violations saga. Time and again, UBS is constantly hiring salesmen to repeat their alleged criminal process against recruited clients, especially the elderly.

_______________________________________

91 YEAR OLD UBS CLIENT HAS LIFE SAVINGS “STOLEN” BY UBS AG ZURICH WHILE ALERTED USA OCC TAKES NO ACTION

Ripoff Report reports: “The large display ads appearing weekly in the Wall Street Journal, by the New York City Office of World Wide UBS Ag Bank, are quite inviting…’At UBS, we know managing wealth means responding to changes in the market, the world and your life…we consider the perfect time to assess where you are headed as an ongoing conversation called, “You & Us.’ My 91 year old friend and elderly patient, Lester Wilken, of Laguna Woods, CA, trusted UBS to manage all his wealth in the Zurich Bank. … (Wilkins) was so blinded with Macular Degeneration he depended on the eyes of UBS executive director … His Zurich manager, Claude E. Ulmann, informed him, “It is better for me to fly a UBS Power of Attorney to your home in CA (Laguna, California) to arrange the trust … he (Wilkins) furnished us the address of Claude Ulmann so we could request he transfer the $250,000 trust fund he assured Wilken was in place in our name. … Wilken’s … died … The UBS Law firm in Zurich then informed me (heir) they would not honor my UBS Power of Attorney even though Claude E. Ulmann was still employed as one of their executive directors in wealth management … Ulmann not only failed to send papers for the trust transfer, he never provided us with the account number or interest earned or mailed a bank statement showing the balance. … The Comptroller of the Currency (OCC), Administrator of National Banks, Houston, Texas, simply informed us my case was assigned the case # 586634 … by Customer Assistance Group, but no assistance has been forth coming.” H3 A pattern is clearly discernible in UBS giving money to the Utah Symphony allegedly for favorable Salt Lake City State and Federal Courthouse treatment. Giving donations to Senator/President Obama through UBS Chairman and custodian Obama Presidential Library+ secret offshore numbered account for foreign donations for immunity from USA Federal investigation/prosecution. All the while, the UBS elderly clients get the shaft. When will UBS ever loose their USA Charter to stop this reign of terror?

_____________________________________________

Helga Marston

ELDERLY UBS CLIENT VICTIM OF ANOTHER ALLEGED UBS SWINDLE

The Toronto Globe & Mail reports: “Born in Barrie, Ont., she was known as Nancy Paul when she started the Canadian Breast Cancer Foundation in 1986 and became a socialite legend on the fund-raising circuit. … Ms. Tsai has been living in Palm Beach following her marriage and 2006 divorce from the late Wall Street fund manager Gerald Tsai. According to records at the Palm Beach courthouse, on Wednesday Ms. Tsai was charged with two felonies: one count of exploitation of an elderly person and one count of grand theft from a person over 65. … The alleged victim is Helga Marston, a World War Two refugee from Romania whose husband, the investment banker Hunter Marston, died a decade ago. … police began the investigation four months ago. That was when financial regulators raised concerns about Dennis T Melchior, a UBS Financial Services broker who worked for Ms. Marston and was also Ms. Tsai’s boyfriend. According to the affidavit, Ms. Marston opened a UBS trust account in 2011 and granted her long-time friend power of attorney, later naming Ms. Tsai as a trustee of the account.” H4 It is doubtful a politically meek FINRA will ever take any further action against UBS or UBS Client victim Helga Marston’s UBS Financial Advisor, other than revoking his license. Again, USA Attorney General Holder and his former Assistant are on public record giving UBS immunity from investigation/prosecution. UBS AG is custodian of the Obama Presidential Library+ secret foreign donor numbered accounts.

__________________________________________

UBS southeast USA regional director Brad Smithy is left. UBS customer is center. UBS Price senior vice president Craig Price.

UBS FIRES SENIOR VICE PRESIDENT PRICE WEALTH MANAGEMENT IN RETALIATION FOR WHISTLEBLOWING ON MELCHIOR ET AL

advisorhub.com reports: “Craig D. Price also charged that UBS violated federal law by failing to file Suspicious Activity Reports with the government after he told managers that the colleague and his girlfriend—the former wife of legendary financier Gerald Tsai—were using her power of attorney over the UBS-domiciled trust account of an “extremely wealthy” childless widow in her nineties (Helga Marston) to advance UBS’ image and her paramour’s career by patronizing and sponsoring charitable events in the Palm Beach area with the client’s money. … The lawsuit liberally cites names of the top brass of UBS’s U.S. wealth management unit. In early 2013 Price notified Brad Smithy, then a complex manager and today one of three division directors at the firm (UBS), of his suspicions that colleague Dennis Melchior and his girlfriend Nancy Tsai were raiding the elderly client’s trust account. He made the allegations after reviewing how credit card and account transaction statements of the trust correlated with Melchior’s business calendar, the lawsuit said. The broker allegedly documented six charitable events sponsored or supported by UBS in the first quarter of 2013, including purchasing a table at a ball held at Mar-a-Lago in Palm Beach, and found “many instances of events to benefit UBS directly or to benefit Melchior….which were authorized by Ms. Tsai” and paid from the trust account, the lawsuit said. He sent details in an email to Smithy, with a copy to UBS Private Wealth Management head John Mathews, the lawsuit said. When UBS fired Price on February 29, 2016, his complex and branch managers said the “decision to terminate his employment went all the way to the top, to Tom Naratil, the new President of UBS Americas, Inc.,” according to the lawsuit. … The lawsuit did not directly explain why Price’s charges would be so inflammatory to the firm. … UBS discharged Melchior in April 2013 for loss of “management confidence” relating to conflct-of-interest concerns involving a trust account, according to his BrokerCheck history. The lawsuit said the firm never amended Melchior’s U-5 termination filing to “accurately reflect his financial exploitation” of the elderly investors. Melchior, who the lawsuit said was promoted by UBS in January 2013 and authorized by Smithy to move from Price’s office to a Palm Beach branch, is currently an independent registered investment adviser”. VD-5 UBS is on record within internalrevenue.com issues 5 & 8 of using similar tactics throughout the USA wealthy enclaves. You will there see incidence formats are more complex containing other UBS collaborators who are recruited to insure success. UBS sucks out of USA 29% of it’s World profits, somehow!

__________________________________________

UBS!

SENIORSAVIOR.COM PICKET UBS

USA Seniorsavior.com was initially created to protect Florida senior citizens from white-collar crime. Seniorsavior.com is so upset at UBS taking advantage of the elderly through predatory banking/broker dealer practices they continue to sporadically picket. This group has not used the media for their picketing, for some reason. It is a good bet they would receive media international attention. Some new signs read:

UBS ARE SWISS PREDATORS

UBS SWISS CRIMINALS OUT OF USA

UBS KEEP OFF U.S. SENIOR CITIZENS

IS UBS SECRET BANKER FOR DRUG CARTELS, DICTATORS, CHILD TRAFFICKERS AND U.S. PRESIDENTIAL LIBRARIES+?

WILL UBS BE ALLOWED TO KILL UBS FUGITIVE CHAIRMAN RAOUL WEIL BEFORE U.S. COURT APPEARANCE OR LIMIT PROSECUTION

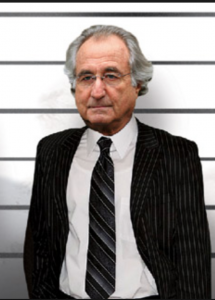

BERNIE MADOFF AND UBS WERE LINKED

UBS ATTEMPTS TO SLEEZE UBS CLIENTS BY REJECTING BERNIE MADOFF COMPLICITY

UBS pickets

_______________________________________

UBS Collaborator Bernie Madoff

UBS & BERNIE MADOFF COLLABORATE ON PONZI SCHEME

Financial Times reports: “UBS seeks to deny duty over Madoff funds. UBS sought to absolve itself from any duty to safeguard investor assets in a $1.4bn fund that channeled money into Bernard Madoff’s alleged $50bn Ponzi scheme. The Swiss bank used an agreement that denied it was responsible for the assets – even though its marketing documents claimed it would be.” H6 Recidivist UBS will never end its sleaze and resulting US crime wave? The UBS client victims list is allegedly longer than that of UBS business associate Bernie Madoff.

_________________________________________

UBS PROMOTED BERNIE MADOFF TO UNSUSPECTING UBS CLIENTS

Associated Press reports: “Luxalpha board member Rene-Thierry Magon de la Villehuchet committed suicide last month when he lost $1.4 billion (euro1 billion) that he had invested with Madoff. Both Luxalpha and Luxinvest were promoted by Swiss bank UBS.” H7 Time and time again UBS denies complicity only to be found out later. How long is this going to go without prosecution?

___________________________________________

UBS SPONSORS PALM BEACH ART SHOW TO RECRUIT WEALTHY SENIOR CITIZENS!

Embassyofswitzerland.com reports: “UBS spent millions of Swiss taxpayer bailout money to finance an art show fete for the wealthy of Palm Beach. UBS created another honey pot scheme similar to the UBS Miami Basil Art Show. During the first night gala UBS gave wealthy senior citizens Champaign, caviar and other foods meant for Madam Pompadour, all at the expense of the Swiss taxpayers. We were present to this fete and interviewed people who loved all the sumptuous activity. It seems UBS operatives were mentioning the fact that off-shore accounts are available but one would have to email www.ubs.com or call +41 44 298 32 32 since UBS is not allowed to talk about such wealth management capabilities in the United States at this time. A Palm Beacher said: ‘I feel sorry for the Swiss people paying millions in taxes for all of this luxurious food and huge art show for Palm Beach.’ Another said: ‘My family lost money to Bernie Madoff who did business with UBS. It is disgusting watching UBS officers swill down expensive food, at least Madoff had class.’ Yet another said: ‘I heard the Swiss government is paying UBS to host this party for the rich of Florida. I am glad I don’t pay Swiss taxes.’ At this very moment 52,000 UBS recruited US wealthy citizens are having their identity betrayed by UBS.” H8 It does not take much to connect the dots.

___________________________________________________

Mary Estelle Curran

IRS & UBS MEDIA ATTACK USA ELDERLY WIDOWER FOR DECEASED HUSBAND’S UBS OFFSHORE HOLDINGS, TO IMPRESS USA CONGRESS!

Bloomberg reports: “UBS Client Mary Estelle Curran, 79 pleaded guilty … ‘but there are a significant number of mitigating circumstances in this case,’ one of her attorneys, Nathan Hochman, said … Zurich-based UBS, the largest Swiss bank, was charged with conspiracy … admitting it aided tax evasion … (Curran) who lives in Palm Beach, faces 30 to 37 months in prison under her plea agreement. … Curran, who had a high school education, inherited an undeclared UBS account in 2000 after the death of her husband of more than 40 years, Mortimer … ‘Her husband was in complete control of their finances until he died,’ said Hochman, a former assistant attorney general who oversaw the Justice Department’s tax division. ‘This was a woman without any financial background at all, none. When her husband passed away, she had no idea how much money there was at UBS.” The case is U.S. v. Curran, 12-cr-80206, U.S. District Court, Southern District of Florida (West Palm Beach).” H9 Reliable UBS source has said this is about pressure from Congress upon Holder and UBS to show their resolve! What better sacrifice than UBS Client Mary Estelle Curran with only a high school education who completely relied upon her husband for finances and then UBS. UBS Client Mary Curran still drives a 2006 Toyota Corolla with manual windows. This was supposed to be an easy betrayal of a UBS Client by UBS. It was not. Elderly Mary Estelle Curran is known as a soft target that rarely fight back against predators.

_______________________________________________________

USA Attorney General Eric Holder

USA ATTORNEY GENERAL HOLDER &UBS SUCCESSFULLY SHIFT CRIMINAL ACTIVITIES ONTO UNKNOWING ELDERLY USA WIDOWER TO DIVERT MEDIA COVERAGE!

Fortune reports: “Mary Estelle … Curran was supposed to be a showcase take down of users of Swiss bank secrecy, a whopper indictment involving a well-heeled resident of Palm Beach, Fla., who failed to report to the IRS that she held $43 million at UBS, the Swiss bank giant … a sympathetic judge last Thursday gave Curran five seconds’ probation and excoriated the prosecutors … Judge Kenneth Ryskamp of Federal District Court in West Palm Beach, even urged prosecutors to seek a presidential pardon for Curran, a homemaker who said she had relied on advisers and rushed to disclose the accounts she inherited from her deceased husband. … Unbeknown to Curran, UBS had turned over her name to the IRS three weeks earlier … Unlike other tax evaders indicted in recent years, Curran did not add money to the accounts, receive cash in paper bags, use secret credit cards, skim profits from businesses, arrange sham loans, or make extravagant purchases. She still lives in the house, with green and white Formica kitchen counter tops, that she and her deceased husband bought in 1982 … Ryskamp said … government decided they wanted to make a felon out of this woman.” H10 A reliable UBS source said UBS and USA Attorney General Holder wanted a media case to show resolve after pressure from Congress. It was decided elderly UBS Client Mary Curran would be an easy mark, the perfect target. Unfortunately for UBS and Holder, an attentive Judge Kenneth Ryskamp saw through the setup UBS ploy. By suggesting an Obama Presidential pardon of UBS Client Mary Curran, the Honorable Judge intimates that he knows who was behind the ploy. Obama/Holder/UBS AG needed a media UBS Client sacrifice for Congress. How many UBS scams are needed to be exposed before UBS looses it’s USA Charter?

_______________________________________

UBS SOLICITS PALM BEACH ELDERLY JEWISH WOMEN WHO SUFFERED THE MADOFF/UBS SCHEME, AGAIN

UBS has increased the size of their offices and put the UBS logo onto the 440 Royal Palm Building. UBS has attempted to distance themselves from UBS trained ‘incentivised’ UBS salesmen by making them independent contractors, like strippers and strip clubs. This is said to allow UBS a ‘plausibility of denial’ while continuing illegal acts. A UBS reliable source said UBS has lined up several Palm Beach elderly Madoff/UBS victims for the UBS ‘perfect experience’. One of these senior citizen widows is known to be confined to a nearby elderly home. It is unknown how UBS gets into private non-profit facilities. Most of those in Palm Beach recruited by Madoff/UBS were members of Temple Emmanuel and/or the Palm Beach Country Club currently attempting to claw back their estate accounts.

_____________________________________________

Letters to the Editor:

Dear Sir/Madam: I’ve been considered a large investor and have never received such information about banker/broker dealers before my local broker presented your newsletter to me. Why on earth don’t other media tell the public about these things? People in California don’t like this UBS AG behavior. It is disgusting. A friend from San Francisco

Dear Editor: I saw full page advertising in the Palm Beach Society Magazine by UBS investment recruiters. When UBS chairman became a fugitive from US justice by not reporting to the Ft Lauderdale Federal court this should have been considered big news. The UBS clients in Palm Beach County should have been alerted with an in-depth article. Question: Is there a correlation between the amount of advertising and critical coverage in media? Palm Beach resident

Director: How do we support you so that UBS can come further under the spotlight? There are many banks and broker dealers that do not like the unfair competitive advantage UBS has in our marketplace. NYC financial

Dear Editor: Your site is funny but sad. I sort of admire UBS because they are doing outright what the other US banker broker dealers have done since their inception. UBS knows how it works because you say they know which Washington political operatives hide money in their Swiss bank. They can take advantage of this more than the homegrown US banks and broker dealers. I would definitely invest with them if they did not do such horrible things to their client senior citizens. I am one of those. – Widower, Montecito, California

Editor: Why doesn’t UBS just “accommodate” you guys the old fashion way? We don’t understand why they victimize a Client rather than making some sort of quiet adjustment. This is what U.S. banks and brokers do. Are they really that arrogant? This is hurting their lobbying effort in Washington. UBS is becoming a joke on the Hill. Why doesn’t UBS just “accommodate” you guys the old fashion way? We don’t understand why they victimize a Client rather than making some sort of quiet adjustment. This is what U.S. banks and brokers do. Are they really that arrogant? This is hurting their lobbying effort in Washington. UBS is becoming a joke on the Hill. Washington “political operative”

Director: How come UBS Financial Services advisor Dennis T Melchior gets fired while UBS Financial Services advisor James A Mahoney is promoted to Executive or Senior Vice President for doing the same thing worse. I think both and UBS should be tried for looting elderly UBS Clients portfolios entrusted to UBS. Mahoney seems to have stolen more client assets from Eunice Gardiner than Melchior. Who in the government went after Melchior’s alleged co-conspirator girlfriend and allowed Melchior and UBS to go free? Why does UBS always go free in the looting of elderly UBS clients? . Legal beagle

Dear Director: Why are there so many UBS Chairmen? As a prior ethical banker I know it is more cost effective to make somebody a Vice President than give them a raise. In essence, banks are tellers who take in money and vice presidents are loan officers who give money out. It is not hard until you get to those who loot customer accounts and have to hire lawyers and pay politicians to get off. – Chicago retired banker

Editor: We will tell you UBS AG is using same routine as done in Africa in U.S.. UBS AG Chief Sergio Ermotti represented UBS AG in Africa. One of UBS AG jobs descriptions is taking in bribes from dictator’s family members and cronies stolen from citizens. They do this by selling natural resources or “dissapeared” aid money. UBS AG instructs through intermediaries how to sanitize stolen money through phony consulting or similar companies. It all ends up in UBS AG vaults under numbered accounts. Why did UBS AG cause attention by becoming a member of the U.S. nationally unregulated Utah Industrial Bank Cartel by giving most cash to Utah Symphony? You say UBS AG brings U.S. elderly UBS Clients to be processed in Salt Lake City Courthouse with UBS AG always getting a phony judgment under UBS AG aliases. We at UN see much bigger UBS AG World criminal activity. We are dismayed this happens in U.S. but we can use it against U.S. pompous policies as being hypocritical. We enjoy very much your newsletter for substantiating what we already know. You also give us delight in your cryptic pronouncements. You can see by our email we are students of your illustrious newsletter. As last point, we have embarrassingly had some dictators loose their positions and then be unable to obtain their stolen money from UBS AG numbered accounts. They come to UN through channels asking us to get their stolen money from UBS AG. Isn’t that something. If you find your newsletter threatened, we will assist your freedoms. – UN readership

Dearest Editor: Did you know Danny Hanley of Gunster Yoakley has not been Roman Catholic? He and his wife have belonged to a small unafiliated Church in Palm Beach started in 1994. Several years ago a member of their family was involved in a scandal at the Church. It was sexual in nature and had nothing to do about recruiting elderly to the Church. Wikipedia says “The Paramount Theatre Building now houses the Paramount Church, a non-denominational Christian church.” The weird thing is the Roman Catholic church is right accross the street from the Paramount Theater church. It is a busy corner on Sundays. Ha, ha, ha. – Palm Beach resident

____________________________________________

Dear Readership:

We are receiving considerable heads-up information from disenchanted UBS reliable sources, be they Clients or employees. We screen the information for credibility and find the results valuable. Many tell of disenchantment within the UBS mean spirited corporate ethic. There seems to be a great concern about the incentive pay carrot given employees to allegedly commit questionable if not criminal acts while using the stick on those who refuse. We know also UBS has a history of destroying inconvenient documents. It seems to be ingrained within UBS ethic. We welcome UBS reliable sources and disenchanted Client, hoping they will continue to send information to us. This gives the World a bit more transparency, however slight. If seniorsavior.com continues to grow and pass the word of UBS predatory practices to the USA wealthy, we see no future for UBS in the USA . One of our goals is to have the UBS AG Charter revoked by USA Congress. UBS AG cannot afford to have Chairman Axel Weber beg in front of yet another Congressional hearing. Of course Swiss political operatives can again force the Swiss taxpayer to disgorge more UBS bailout money in an attempt to stop the inevitable.

Issue 5 will be a continuing scroll with no forceable ending. It will show the documented alleged criminal actions taken against the Gardiner’s Island Long Island New York Family by UBS and several co-conspirators. Among other things, UBS has teamed up with a highly controversial law firm known for looting Florida elderly estates. Gunster Yoakley recently lost a case against the Gannett heirs having to pay more than $1,000,000 in damages for looting their Father’s estate. At the very same time Gunster was allegedly preparing to successfully loot Gardiner Island Family’s Island estate worth approximately $147,000,000. The alleged criminal looting has been a continuing success for UBS and their co-conspirators. UBS has continued their reign of terror on the Florida elderly by allegedly successfully forging documents of elderly Eunice Gardiner in furtherance of the scheme. Eunice Gardiner’s UBS salesman and his family were living in Eunice’s home but were told to sell it by UBS. UBS salesman’s wife was beneficiary according to Gunster Yoakley, Daniel A Hanley and Alexandra M Woodfield created documents. Alexandra M Woodfield of Gunster was appointed personal representative by UBS/Gunster and confirmed by the Palm Beach Court. Woodfield then appointed UBS salesman Mahoney and her Gunster boss Hanley as trustees of a trust created by Gunster 3 days before Eunice’s disoriented death.

UBS, Gunster and other perpetrators did something with Eunice’s body during the unaccounted several months that is still not fully understood. Eunice Eunice died July 26, 2011 but death certificate registered November 8, 2013. Speculation has it that Eunice’s body was defiled when it disappeared in alleged custody of UBS. Eunice supposedly lies with her cherished jewelry and other fond items under a small plaque noting her new phony name allegedly created by UBS/Gunster perpetrators. A reliable source has said Gunster/Hanley are allegedly working on two other Palm Beach area elderly women at this time, one in Hobe Sound. UBS is aggressively recruiting elderly clients for their “perfection experience”, according to a reliable UBS source recently attending the UBS 600+ “breakout” conference at the Palm Beach, Breakers Hotel. It is so sad the USA elderly victims are being treated in such a way. You can judge a country by the way they treat their elderly.

We offer our condolences to Helga Marston’s European family and hope her friends assist us in our quest to revoke the UBS Charter in USA. We do not know if Helga’s estate assets in the alleged possession and control of UBS and their UBS Financial Advisor will be retrieved. UBS reliable sources have said there are several other elderly women that are in the midst of being processed for the UBS “perfection experience”.

With a little coaxing, we believe other UBS Client victims will be coming forward once the seriousness of the scandals fully emerge. This was the victim scenario that played out with the Madoff/UBS scandal. Once the scandal cascaded it became fashionable for clients to come forward saying they were a victim of Bernie Madoff/UBS. Washington Congressional Committees are awaiting the USA Federal trial of UBS prior fugitive from USA Federal Justice CEO Raoul Weil in Ft Lauderdale, Florida. Again, UBS CEO Raoul Weil knows too much. Raoul may be accidented or suicided. UBS should suffer the same plight as Bernie and at very least loose their USA Charter.

Director@internalrevenue.com